The crypto market fell in the wake of the CFTC’s action against Binance. Meanwhile, the market faces a liquidity crisis triggered by the shutdown of Silvergate’s SEN and Signature’s Signet network in early March. Let’s see what’s happening in the market.

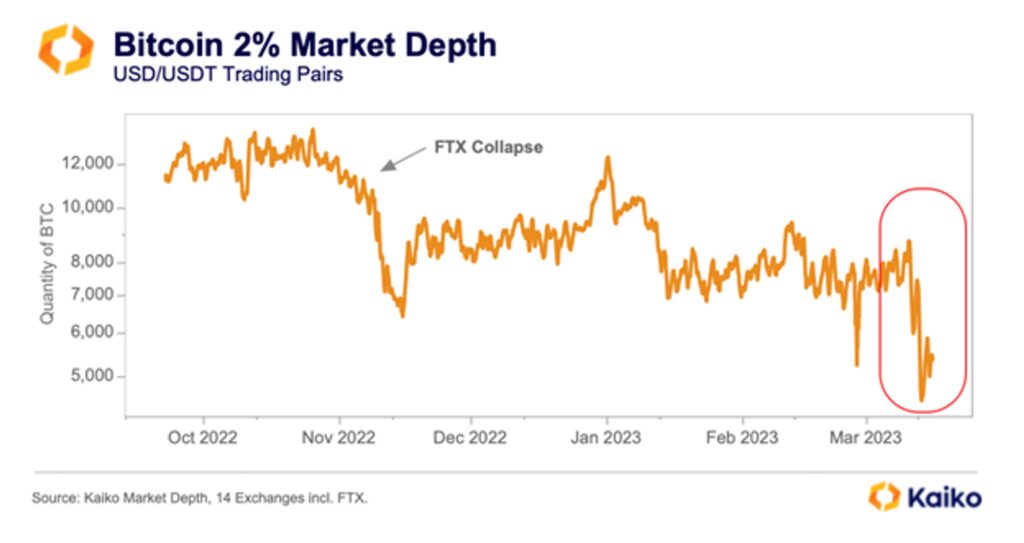

Bitcoin Liquidity at 10-Month Low

Despite Bitcoin’s stellar performance this year, investors may still be wary due to its low market liquidity. An indicator tracking the ease of buying and selling Bitcoin has dropped, hitting a low not seen in the past ten months.

Evaluating the buy and sell orders in the market maker’s order books, with a 2% maximum deviation from the token price on either side, is crucial in calculating this metric.

Besides, the drop in market liquidity can be traced to a lack of dollar-payment methods available to firms dealing in cryptocurrency trading.

With market observers on high alert for further repercussions or turmoil, the ebb in liquidity has happened as Silvergate Capital Corp. and Signature Bank, which had close ties to the crypto industry, collapsed in recent weeks. These financiers had provided banking services to many digital asset companies, and exchanges had used them for real-time transfers, among other things.

Investors are on tenterhooks as they await the fate of Bitcoin.

Nonetheless, even though the market has proven resilient in the past, the current liquidity crisis poses a serious threat to its stability. It’s unclear whether the current Bitcoin momentum will last or give in to the turmoil.

Moreover, low liquidity in financial markets tends to result in high volatility, which can impact prices in both directions. It is because prices have reduced support both on the downside and the upside.

The post-FTX decline in volume, or the “Alameda Gap,” illuminates how crypto market liquidity vanished in the absence of one of the major digital asset market movers. Following the Silvergate and Signature banking crises, which cut off market makers from vital USD payment rails, that liquidity gap has not recovered and keeps falling to new lows.

Fortunately for investors, a surge in purchase demand brought on by the banking confidence crisis has driven the price up. However, the absence of support on the upswing also holds true on the downside, so we must be equally wary of an oversized move downward in the upcoming weeks.

Binance Hit With $218 Million Outflow Amid CFTC Legal Action

There have been accounts of sizable capital outflows following the news of the U.S. Commodity Futures Trading Commission’s (CFTC) lawsuit against Binance, the leading CEX. Since the CFTC announced the legal action, there have allegedly been withdrawals of $218 million from the exchange.

Moreover, users have expressed worry after the CFTC charged Binance with breaking U.S. trading and derivatives regulations.

The market frequently experiences token withdrawals, which can be a standard component of the ebb and flow of trading activity. However, the timing of these withdrawals is notable as it relates to the proceedings surrounding the Commodity Futures Trading Commission’s lawsuit and the legal steps taken against the CEX.

Regarding inflows, Binance has noticed a rise in deposit activity in certain areas like Asia. It appears that some users are taking advantage of the market volatility by buying tokens at reduced prices while others are withdrawing their funds from the exchange.

Ethereum: Is It a Security or a Commodity?

Binance was charged on March 27 by the Commodity Futures and Trading Commission (CFTC) for breaking federal laws. Notably, the governing authority asserted that Ethereum is also a commodity in its case.

This lawsuit occurred weeks after the Securities and Exchange Commission closed down Kraken’s crypto-staking service, wherein they classified ETH as a security.

The conflicting opinions on whether Ethereum belongs in the category of a security or a commodity are to blame for the industry’s lack of regulatory clarification.

This incident is not the first; earlier this year, SEC Chair Gary Gensler and the CFTC Chair reaffirmed that ETH should be treated like a commodity.

According to their definition, “security” is a financial commodity or instrument with a worth that can be purchased, sold, or traded. Stocks, investments, etc. are examples of the same. Contrarily, a “commodity” is a tangible product exchanged on exchanges whose worth is based on supply and demand.

Since staking is a necessary component of using Ethereum, it falls more into security than a commodity. On the other hand, Bitcoin, which has financial similarities to gold, is more akin to a commodity than a security.

However, if Ethereum is deemed a “security,” it will affect the platforms that intend to list it. These platforms and exchanges must file with the SEC as a “securities” broker-dealer or delist ETH to avoid trading securities illegally. As a result, it would affect both centralized trades and decentralized exchanges.

Furthermore, this development could further shake the already dwindling trust in exchanges.

Source: Santiment

On March 27, users transferred their ETH to self-custody wallets or staked it, dropping the Ethereum volume on exchanges to just 10.3%. It is the lowest supply level since the cryptocurrency’s inception in 2015.

Moreover, the collapse of FTX has left ETH holders’ trust in these exchanges unsettled, resulting in a decrease in the amount of ETH held by exchanges to below 12.5 million ETH ($25.4 billion).

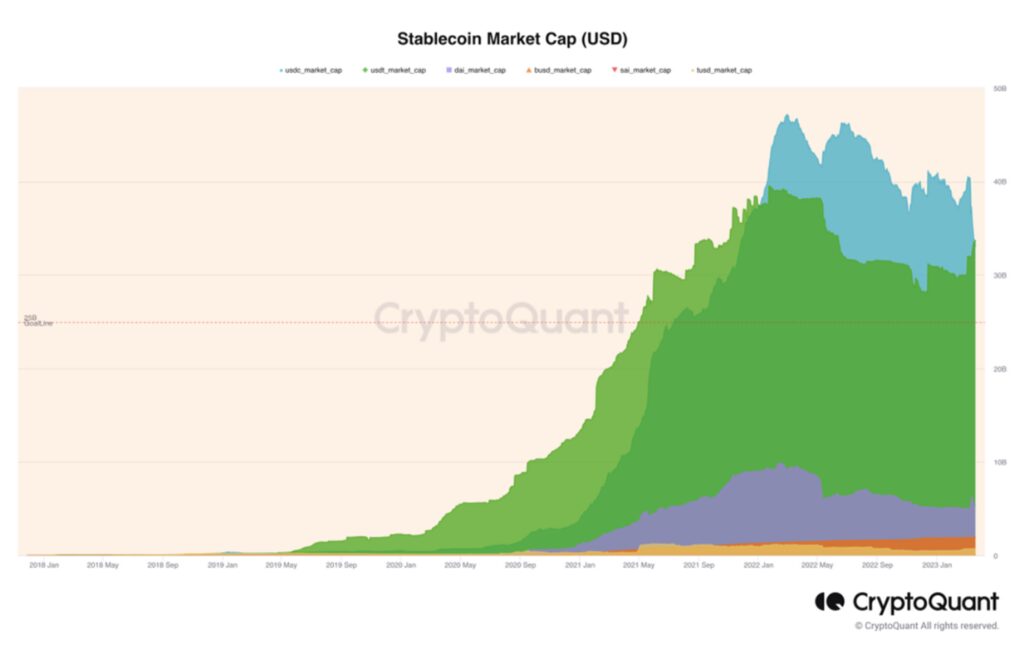

Battle for Stablecoin Dominance Heats Up

As the war for stablecoin shares rages on, which stablecoin will prevail, USDT with a 44.60% market capitalization or USDC with a 43.78%?

The fall of the USDC stablecoin is one of the repercussions of the banking crisis in the United States, which is at its height right now. Its market capitalization declined by 7.06%, while the USDT stablecoin grew by 6.2%.

Besides, the “old money” USDT currently has a greater chance of winning the battle for the leading global stablecoin. We should support market rivalry in general, but a secure stablecoin is what we need.

In Web3, stablecoins are digital assets pegged to the value of fiat money or other commodities like gold or oil. Compared to other cryptos, which are subject to substantial market price changes, stablecoins are more stable.

The two stablecoins currently most in demand are USDC and USDT. Both stablecoins enjoy a sizable portion of the cryptocurrency market valuation, indicating strong investor demand.

Source: CryptoQuant

Currently, USDT has a slight edge over USDC because it is not losing market capitalization share. However, there are benefits to USDC as well, such as increased operational transparency and frequent financial statement audits.

In any case, the rivalry between these two stablecoins is advantageous for the cryptocurrency market as it encourages product improvement and higher user security standards among developers.

The stablecoin race may thus go on for a very long time, but eventually, the winner will be the one who offers the finest product tailored to the market’s needs.

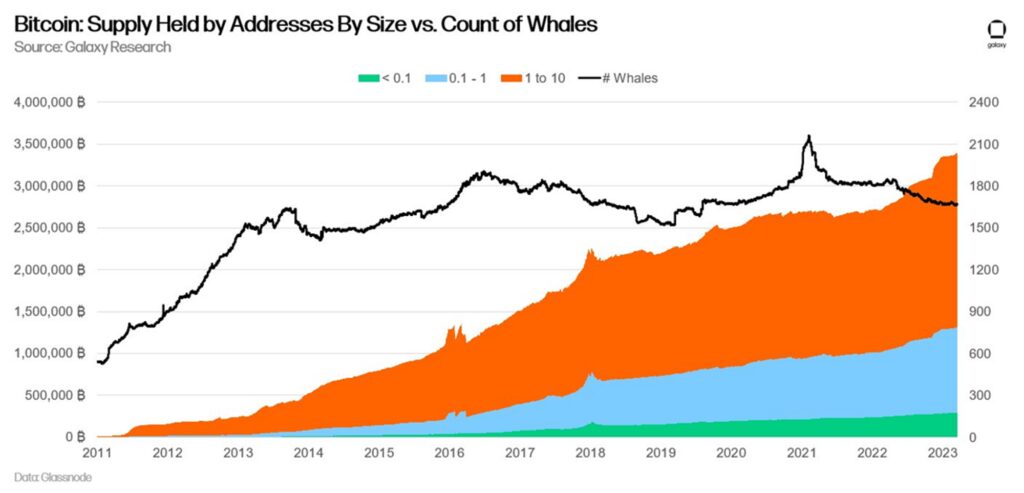

Whales Exiting?

Analysis of Bitcoin addresses by their holdings reveals a notable trend: smaller investors are increasingly accumulating while the number of more prominent investors, or “whales,” is declining. This trend appears to have accelerated following the recent collapse of FTX, which has seen a sharp drop in the number of whales holding over 1,000 BTC.

Moreover, the decline in whale numbers suggests that these investors seek to diversify their holdings across multiple custodians and addresses or are considering exiting the Bitcoin market altogether.

In contrast, smaller investors with 10 BTC or fewer holdings have consistently accumulated approximately 30,000 BTC per month, exceeding the network’s issuance of around 900 BTC/day.

This data suggests that smaller investors are becoming a significant force in the Bitcoin market, accumulating a growing share of the crypto and potentially exerting a more substantial influence on its price trajectory.

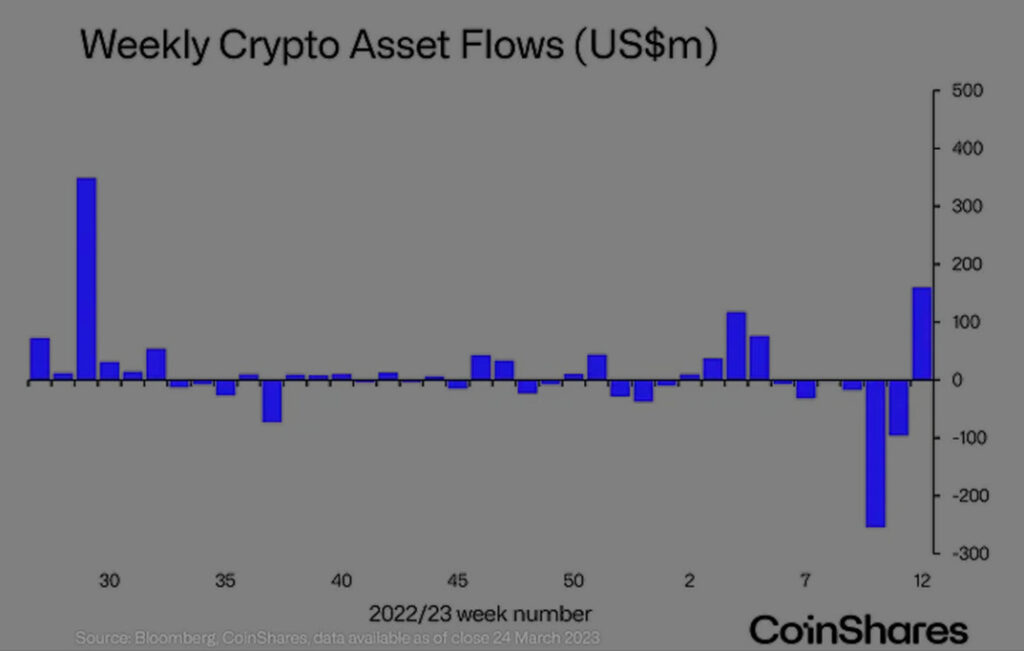

TradFi Worries Drive $160m Inflows to Crypto

For the first time since July 2022, investments in digital asset assets saw inflows totaling US$160 million. After US$408 million in withdrawals over the previous six weeks, this is a dramatic reversal. Nevertheless, compared to the overall crypto market, the inflows arrived relatively late; this might be because investors are growing more concerned about the stability of the traditional financial sector.

Source: CoinShares

Moreover, the fact that the deposits came from numerous nations suggests a general upsurge in the positive outlook for the asset class. The most significant outflows, totaling US$69 million, US$58 million, and US$26 million, respectively, were from the U.S., Germany, and Canada.

Money is pouring into money market funds as investors worry about the security of the financial system and as tighter monetary policies are causing liquidity woes for banks in the United States and Europe. Due to their high liquidity and low risk, money market funds are popular among investors during economic instability. These funds are currently offering some of the best returns in years due to the consistent interest rate increases by the U.S. Federal Reserve to combat inflation.

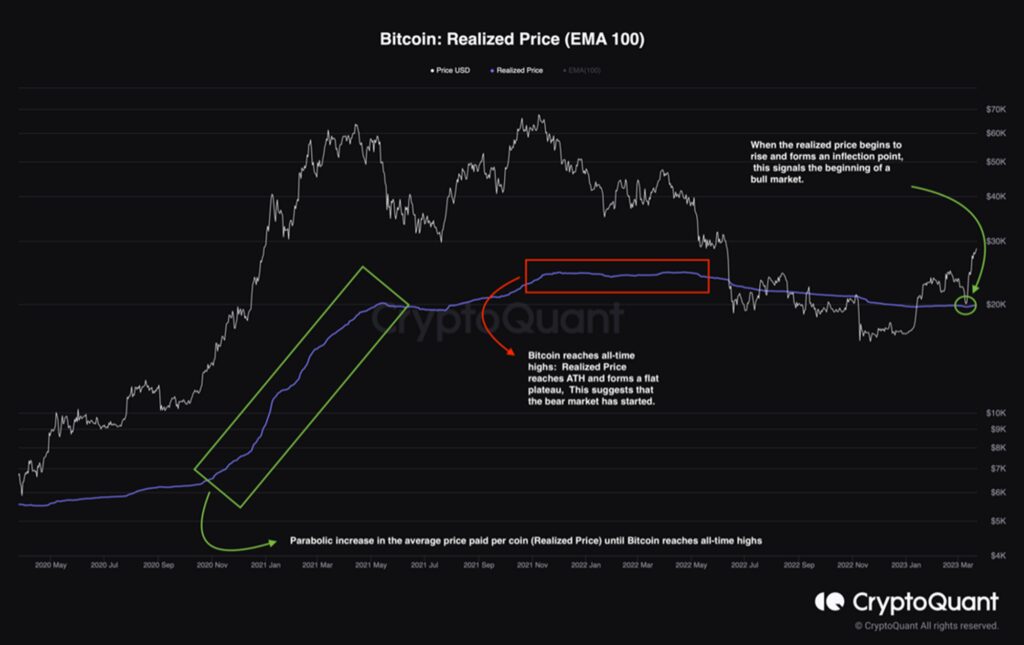

Bitcoin’s Realized Price and Market Dynamics

Realized Price represents the average cost base of all bitcoins in circulation. Its calculation involves dividing the worth of all bitcoins at the purchase price by the total number of bitcoins in circulation. The concept of Realized Price is founded on the notion that each UTXO is valued at the price it was last moved between wallets.

During bull markets, the Realized Price of Bitcoin usually rises because buyers who purchase tokens at greater prices are more prevalent. The average price per coin increases in a parabolic fashion until Bitcoin reaches all-time highs. As soon as this occurs, the Realized Price usually forms a flat plateau.

During bear markets, the Realized Price may marginally fall. For instance, the Realized Price declined from its December 2021 value of $24,500 to lower levels (gradually from levels around $24,500 to levels below $20,000) during the most recent bear market in January 2023.

The cause for this decline is that long-term holders acquire Bitcoin at reduced rates, which lowers the Realized Price (LTH realized price). Besides, the Realized Price of Bitcoin reached its lowest point of the bear market during the recent 25% drop in Bitcoin’s market price, which occurred this month and brought its value to $19,800.

Moreover, the high demand pressure on Bitcoin led to massive accumulation as its price dipped below $20,000, which caused the Realized Price to reach $19,700, indicating a turning point.

An inflection point in the Realized Price usually marks the shift from a bear market to a bull market. Due to rising demand, there is a good chance that the Realized Price of Bitcoin will surpass the $20,000 mark and return to its ATH values.

Bitcoin the New Safe Haven?

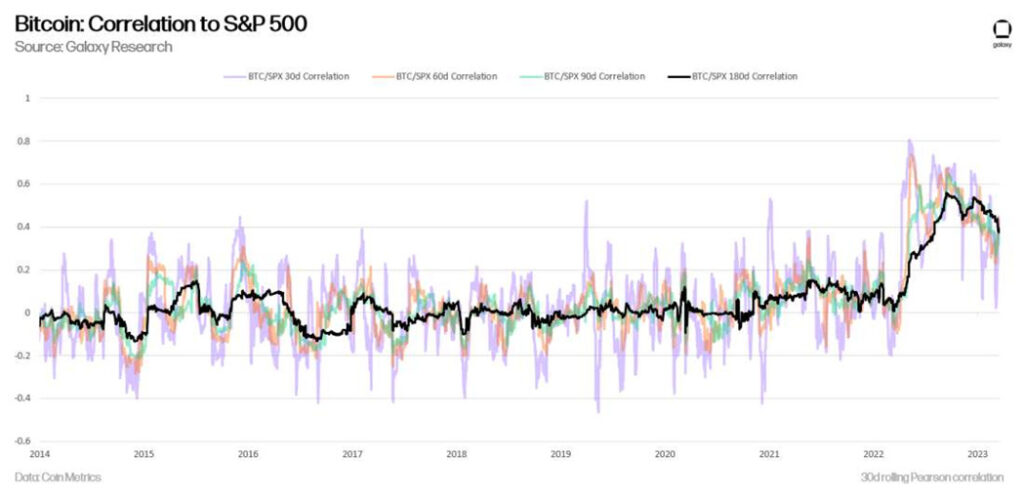

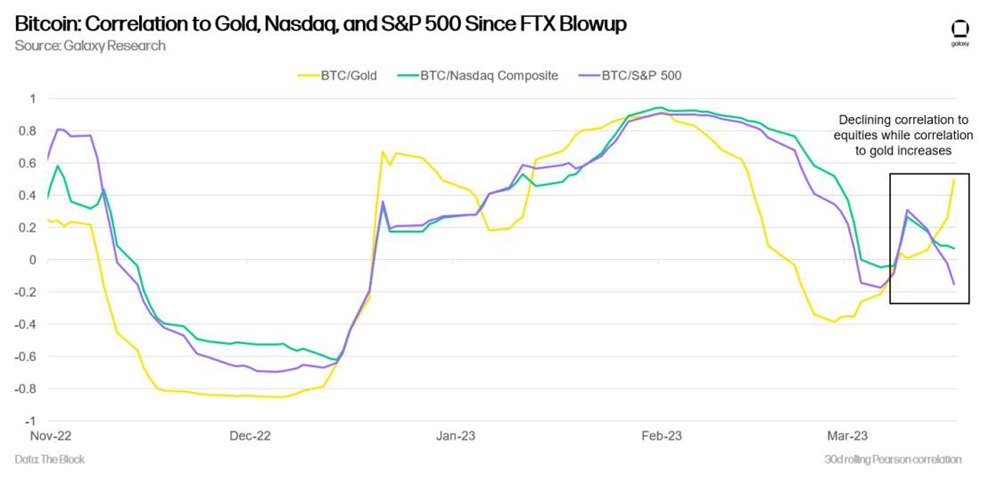

In the past few months, the correlation between Bitcoin and equities has decreased after remaining at an elevated level for 18 months. Notably, since the onset of the banking crisis, Bitcoin’s correlation to equities has dropped, while its correlation to gold, a traditional safe-haven asset, has significantly increased. This trend suggests that, at least in recent times, Bitcoin has been behaving more like a safe-haven asset than a high-risk asset.

Source: Galaxy Research

Source: Galaxy Research

With the current crisis testing the limitations of the fractional reserve banking system, Bitcoin’s fundamental characteristics can offer a safe haven for investors if custody or self-custody is appropriately managed. These correlation data demonstrate that Bitcoin has unique properties that can differentiate it as a safe port in a storm.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.