Here’s our fourth and last article on Crypto Trends for 2024. We loosely based all articles on this Messari report.

So, without further ado, let’s dive straight into the last part of Crypto Trends for 2024.

#24 The wallet war is the most interesting, highest stakes, and least talked about war in crypto.

The resulting arms race will level up crypto from a speculative asset to a safer, easier, mainstream consumer tech in 2024. pic.twitter.com/xa2SruzquD

— Ryan Selkis (d/acc)🪳 (@twobitidiot) January 2, 2024

Consumer Crypto Trends

- DeSoc

DeSoc (Decentralized social media platforms) are coming on strong. And we need them. No more social media censorship. Lens and Farcaster are leading this charge. However, there are other platforms available. It’s important to start interacting with more than only X. Have a backup available. One of the biggest takeaways is that creators get rewarded for their work. Drip Haus is a prime sample of this.

Friend.tech was the major platform this year, with $50 million generated in fees. It’s the stepping stone for a more fine-tuned version of DeSoc platforms.

- NFTs

The NFT space took a hit this year. The biggest marketplace, OpenSea, took a nosedive. However, projects with utility and innovation are prevailing. Solana even managed to outperform Ethereum at times. Solana offers cNFTs (Compressed NFTs). These reduce storage costs for NFTs. Minting NFTs also becomes a lot more affordable.

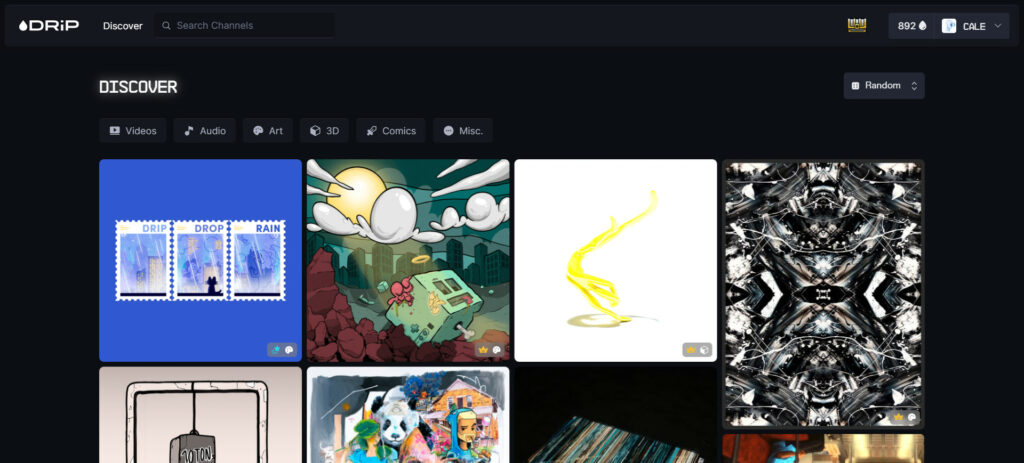

Where else can you mint almost a million NFTs for $100? The next big thing seems to be Ordinals, and not only on Bitcoin. Below is a picture of NFTs on Solana’s Drip Haus.

Source: Drip Haus

- BRC20 and Ordinals

An NFT sector that almost came out of nowhere and surged, is Ordinals. The inscribed Satoshi (sat) is the smallest Bitcoin denomination. The Taproot upgrade allowed for inscribing Satoshi’s. All of a sudden, you could turn a sat into an NFT. This led to various unexpected, but welcome side effects.

For example, Ordinals grew 300x, and their price exploded. Of course, the Bitcoin maxis didn’t and don’t like Ordinals one single bit. That’s a discussion that will continue for a while. Should Bitcoin only be for transactions, or can you also use it to inscribe sats?

In the shadows of the Bitcoin Rare Sat Marketplace, a revolution is unfolding.

The emergence of the enigmatic Black Sat Rarity has compounded the usage of Bitcoin to immortalize data, creating a multi-million dollar marketplace for thousands of first-time Bitcoin #Ordinals… pic.twitter.com/6lzHkAwJIX

— Black (@BlackxBTC) January 10, 2024

-

Blockchain Gaming

Blockchain gaming is one of the most anticipated crypto trends this year. Will it finally be the breakthrough year? Plenty of long-awaited games should launch. Illuvium, Star Atlas, and Shrapnel could ignite the space. Vulcan Forged’s PYR is waking up from a price coma.

Last year’s gaming revenue was around $184 billion. Even a small piece of this action is interesting. Blockchain gaming has a few challenges, and one is to make it more appealing for gamers to join. Crypto needs a couple of 100k DAUs (daily active users) per game. Polygon and Immutable seem to be the market leaders.

Build your game on easy mode.

Join the biggest network of builders in web3 gaming here at Immutable 🔨 pic.twitter.com/cWZ3sy5Cuh

— Immutable (@Immutable) January 3, 2024

Peer-to-Peer Infrastructure

- Crypto Wallets

The crypto wallet space is a mess. Each chain has various wallets that only work on their specific chain. Yes, there are multichain wallets. However, mass adaptation requires a universal wallet that users can use everywhere. The users shouldn’t have to know on what chain they are or what asset they need. The wallet should sort that out for them.

Onboarding wallets is another issue that hinders mass adaptation. Lukso and its Universal Profile could be an answer. Or at least a step in the right direction. Use Web2 methods to sign up for Web3 functionality. There’s no more need for seed phrases. Account abstraction is another buzzword right now. It allows you to control your funds, instead of the smart contract. However, the smart contract still manages the funds.

The Universal Profile Browser Extension v3.0.0-beta.5 is now live with smart contracts v0.14.0 integrated ⛓️

Learn more about the technical update on LSP7 & LSP8 in the article below 👇 https://t.co/uiyBgfghlg

— Universal Profiles (@ERC725Account) December 21, 2023

DePin Storage

DePin has two different legs it stands on. One is location-dependent, the Physical Resource Networks (PRNs). For example, energy or connectivity. Protocols like Akash or Render cover this section.

The other leg is Digital Resource Networks or DRNs. This is not physical, since it is cloud orientated. Like storage or bandwidth. So, here’s why this is such an interesting market segment. Cold storage is an $80 billion market that grows 25% per year. However, decentralized options only cover 0.1% of this market.

That’s when they are even 70% cheaper compared to big boys like Amazon. The big, decentralized storage players are Arweave, Filecoin, Storj, and SIA.

Arweave is kicking off the New Year and 2024 with some wild stats.

Over 500GB+ of data has already been uploaded through @ardriveapp Turbo.

More than half a terabyte of data added to the weave. Why?

Hint: There's a new AI app on Arweave. 👀

A quick look into the figure:👇 pic.twitter.com/OKNU0afDTL

— Only Arweave (@onlyarweave) January 9, 2024

Conclusion

This is Part 4 of our 4-part series on Crypto Trends for 2024. We covered consumer crypto trends and Peer-to-Peer infrastructure. We come to the end of this series, but here’s a link to Part — 3.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.